SIE stands for Securities Industry Essentials, and the exam is hosted by the Financial Industry Regulatory Authority (FINRA). If you didn’t already know, securities are the official name for investment vehicles such as stocks, bonds, and mutual funds. The SIE exam will cover the basics of investing, which include investment products, regulations, and general industry practices. To pass this exam, you will be required to demonstrate a fundamental knowledge of the finance industry.

The answer is: No! You can take the SIE without sponsorship from a FINRA firm. This is a great way to improve your resume and show firms both that you’re serious about a finance career and that you understand key industry concepts.

You should prepare for the exam using a FINRA SIE Exam prep course (see our comparison of different SIE Exam prep vendors). Once you’re ready, you can sign up to sit for the SIE Exam by registering on FINRA’s website and then visiting their Schedule An Exam page.

However, the SIE by itself does not fully license you for any of the licensed finance roles. In order to complete your license, you need to take a top-off exam.

The FINRA Top-Off Exams are:

Series 6: Investment Company Representative (IR)

Series 7: General Securities Representative (GS)

Series 22: DPP Representative (DR)

Series 57: Securities Trader (TD)

Series 79: Investment Banking Representative (IB)

Series 82: Private Securities Offerings Representative (PR)

Series 86 and 87: Research Analyst (RS)

Series 99: Operations Professional (OS)

You will need to be sponsored by a FINRA firm to be eligible to attempt and pass those exams above. Once you pass the SIE and corresponding Top-Off Exam, you will get the license listed above.

FINRA expects students to spend around 50 hours to be suitably prepared to pass the SIE. Keep in mind – the test is pretty new, so the industry is still collecting data on this.

We can’t study for you, but the learning science behind Achievable is tremendously efficient.

We track your progress through the content and schedule reviews at the optimal time to improve you retention – getting you the most out of every minute you spend studying.

You can take the SIE as many times as you want, but there are restrictions on how long you must wait between failed attempts. The FINRA SIE follows the same waiting period requirements as all other FINRA exams:

However, as long as you stay dedicated, you can take the SIE as many times as you want.

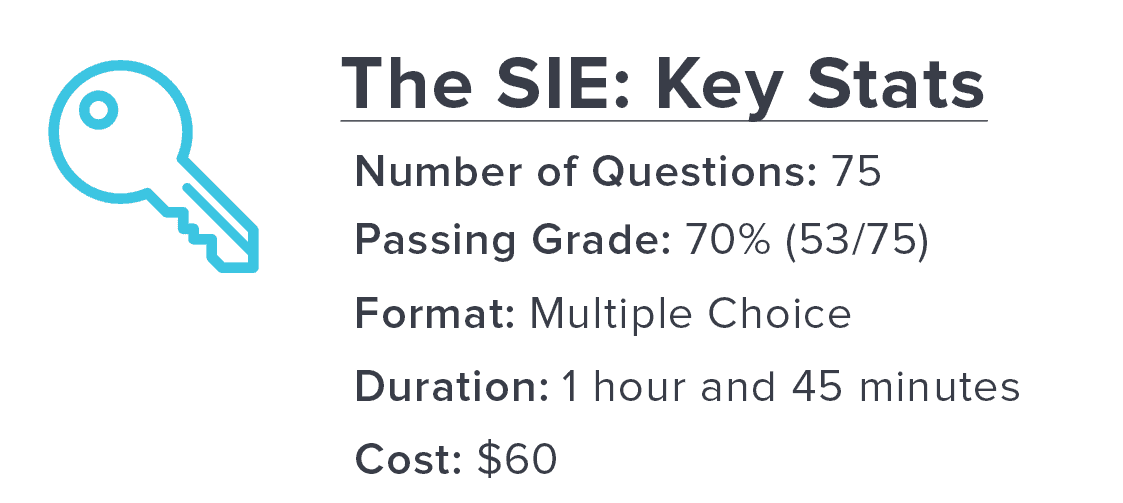

The Financial Industry Regulatory Authority (FINRA) administers the SIE, which is a 85 question exam. 10 of the questions are considered “experimental” and do not count towards your grade. In total, 75 questions will count toward your final score. The test is broken down into these categories:

Section | Questions | Weight |

|---|---|---|

Section 1: Knowledge of Capital Markets | 12 questions | 16% of the test |

Section 2: Understanding Financial Products and their Risks | 33 questions | 44% of the test |

Section 3: Understanding Trading, Customer Accounts, and Prohibited Activities | 23 questions | 31% of the test |

Section 4: Overview of Regulatory Framework | 7 questions | 9% of the test |

Total | 75 questions | 100% |

This chart may vary slightly based on how the content of your specific book line up with the FINRA syllabus, but this rubric is a great starting point.

Now, digging into the content by category, you can get much more specific about what to expect. Let’s analyze the sections, starting with the largest:

Understanding Products and Their Risks – 33 questions – 44% of the exam

In the world of finance, you may only be aware of stocks. However, there are many financial products investors can choose from. Thankfully, the SIE exam will focus only on a small selection of investments, which include:

Each of these products has benefits, risks, and fit a specific type of investor. These characteristics, along with how they function and how they are taxed must be known for the exam. In addition, there are the underlying ethics, rules, and regulations of each.

Understanding Trading, Customer Accounts, and Prohibited Activities – 23 questions – 31% of the exam

After you learn the various financial products, you’ll need to learn the rules of trading them and what type of accounts hold them. In addition, there are rules and ethics that must be understood to operate as a financial professional.

Trading securities can be detailed and complicated, but the SIE tends to focus on the basics. You’ll need to understand how investors do financial transactions and the different ways to submit orders to the market. Investors can specify certain requirements for their trade: for example, requesting that a stock be bought for $50 or less. You’ll need to demonstrate proficiency in the basics of trading securities and the mechanics of the financial markets.

Customers can open and maintain several different types of accounts. You will be asked questions on the specifics of these accounts, including ownership status, tax status, and paperwork required to open them. The accounts typically tested include:

Registered representatives understanding the ethics of finance is very important to FINRA. You’re going to see questions on items ranging from market manipulation to insider trading. It will be your job to demonstrate a general knowledge of what to avoid and how to ethically operate in finance.

Knowledge of Capital Markets – 12 questions – 16% of the exam

You might be wondering what a capital market is. Capital is another term for an asset, which usually takes the form of money in finance. When a company or an organization wants to raise large sums of money, it can do so through a variety of means. You may have heard of an IPO – initial public offering. That’s one of the most common ways to raise capital in finance.

In addition to understanding how companies and organizations raise money through selling financial products, you’ll need to know finance regulators and how they operate. The SEC and FINRA write rules and regulate these markets. In addition, the MSRB (Municipal Securities Rulemaking Board) writes the rules for the municipal (city and state) market.

Economic conditions have an affect on the financial markets and investors. Therefore, the SIE will test you on the basics of the economy and how they may drive decisions made in the market. Government decisions (monetary and fiscal policy) are also tested and must be understood.

Overview of the Regulatory Framework – 7 questions – 9% of the exam

Rules, rules, and more rules. Whenever the word “regulatory” appears, you’re going to be required to recall laws, regulations, and general rules of the industry. As a registered representative, there are many conduct rules you must understand and follow to work in the industry. Typical questions from this section focus on:

Bonus: Experimental Questions

The SIE exam that you take will have 85 questions, with 10 of those questions being “experimental” questions that don’t count on the final exam. Don’t sweat this too much – just answer them as normal and be confident in your approach. This is one of the reasons why it’s so important to skip questions where you are “stuck”, which we will cover more in our Test Taking Strategies post.

Analyze the content and rate your knowledge

When you’re planning out your last couple weeks before test day, be sure to spend a bit of time with each section before planning – and do a couple practice questions from each one. You can probably already tell which sections you need more practice with. Take note of your confidence with each section.

Prepare a study schedule

Give yourself a time budget for how many hours you plan on studying between today and test day. Be realistic – the goal here is to set an appropriate schedule. For reference, most SIE courses recommend 50 hours to learn the material. If you’ve already been reading through the material and are just planning your final review, 20 hours is often recommended.

Once you have your budget of hours, you need to split up your time according to two factors: how confident you are with each section, and how much of the exam is comprised of that section. You want to spend the most time studying the highest value topics where you have the most room to improve. Your goal is to maximize the impact on your score in the budget of time that you have. Make sure to take lots of SIE exam practice questions so that you can ensure you’re properly prepared.

Schedule? I have no time!

But wait, what if I’m far behind and the test is in a few days? You will be happy to hear that you can, in fact, get through more content than you think. In controlled studies, most students see a drop-off after studying for more than three hours in a row, but with just an hour break they can study another three hours with similar success. This doesn’t make for the best results, but it can do in a pinch.

The best results? You get those by studying consistently over at least a couple weeks and reviewing the material you’ve already studying as you progress.

One of the most commonly asked questions of FINRA instructors is “what is taking the test actually like?” We wanted to share some insights with you on the Achievable Blog with the help of our partner Brandon Rith.

Preface: preparing for test day

Before talking about what happens on test day, we wanted to remind you that how you approach test day makes a big difference in your experience. Make sure you’re bringing your best self to the test day: get plenty of sleep the night before, eat a bit of food beforehand, and maybe perk yourself up with a workout or some jumping jacks. This also helps a lot with nervous energy: you’re going to perform much better if you are cool, calm, and confident going into the exam.

Now that we’ve covered that, let’s get into the details of what happens at the test center.

Checking in

Don’t be intimidated by the test center. The building is more like a doctor’s office than anything else.

When you first walk in the door, you’ll need to tell them what test you’re taking and give them a current government ID like a driver’s license or passport. Then you’ll need to sign a disclosure form that’s pretty straightforward: no cheating, don’t bring weapons into the test center, etc. After that, you put your belongings into a locker except for that same ID. They will also ask you to turn off your cell phone before putting it in the locker.

Once that’s done, you’ll be taken to another part of the test center to be ‘admitted’ to the test environment. This consists of answering a couple more questions and being patted down like you were going through an airport security checkpoint. This is to ensure you’re not somehow bringing notes in. They will also take a picture of you for their records, in case there is a dispute about someone else taking the test on your behalf.

The SIE Exam Test Experience

Once you’re admitted, you will enter a completely silent room with a bunch of computers and other test takers. They’ll often be taking other tests than the one you’re taking, so there’s no sense in trying to take a peek. The room is also fully covered by security cameras.

You’re sat down at your computer and given your ‘scratch paper’, which is really a laminated sheet and a dry erase marker. You are also given a pair of noise-canceling headphones, which is great for concentration – some test centers will also give you earplugs if asked as well. You then need to take a tutorial of the computer test system to ensure you know how it works. Then, finally, it’s time to take the test.

The test experience you have taking the test will depend on the test itself, but a couple things commonly happen that you can plan for. First, if you have anything you want to keep track of, whether that be key equations, notes, or frameworks – write them down immediately after your test starts. That way you won’t need to re-remember them later in the exam and can stay ‘in the zone’ of answering questions. And second, don’t be distressed if you do end up getting nervous at this point. Even experienced test takers will get nervous at the beginning of a new test – focus on answering the first 10 questions and your nervousness should go away.

Once you finish the test, you’ll be prompted (sometimes at length) to confirm that you’re happy with your answers and ready to submit your exam answers. For most FINRA tests, you will get a score back immediately following that screen. This will tell you whether you passed right away!

Then, you just need to gather your belongings and head out. You may be asked to fill out a survey about the experience (was the test center accommodating, etc) but otherwise, you can just pick your stuff out of your locker and sign out. When signing out, be sure to get a printout documenting your score if you passed so that you have a paper copy for your records. And that’s it! Your test is complete.

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

Unsexy but mighty, bonds represented $39T in net value WW in 2015, while stocks were worth approximately $26T. Basic Wisdom’s Brandon Rith walks you through how they’re handled in the wealth management profession.