If you want to work in the securities industry, you will need to take some exams to get a license. These exams assess your expertise in various related areas, including securities themselves (products), investment advice, and state laws. In this article, we’ll explore the Series 63, Series 65 vs 66 exams, their differences, content, job opportunities, and how to prepare for success.

First, a little background: the Series 63, Series 65, and Series 66 exams are administered by the Financial Industry Regulatory Authority (FINRA), but are created and maintained by the North American Securities Administrators Association (NASAA).

NASAA and its securities administrators are the ones responsible for enforcing the Uniform Securities Act in every state. They safeguard investors and aim to maintain fairness in all transactions in the securities industry.

Formed in 1919 in Kansas, NASAA’s mission was to standardize securities laws across states, so that the public is protected against fraudulent activities and schemes. The Uniform Securities Act earned the nickname “Blue Sky Laws,” reflecting the early days of securities regulation when schemes seemed as substantial as “so many feet of blue sky.”

First, let’s start with the Series 63 to cover all of our bases. The Series 63 test, or the Uniform Securities Agent State Law Examination, is a test that covers the fundamentals and rules of state securities regulation. The majority of states require it of anyone who wishes to sell securities or provide investment advice within their borders.

The Series 63 test has 60 multiple-choice questions and lasts 75 minutes. You want to score 43 out of 60, or about 72% to pass. The test covers topics such as:

The Series 65 test, or the Uniform Investment Adviser Law Examination, is a test that covers the laws, regulations, and ethics of giving clients investment advice. Most states will require it from anyone who wishes to offer fee-based investment advice to clients.

The Series 65 has 130 multiple-choice questions and lasts 180 minutes. You want to get at least 92 questions right, or about 70% to pass. The test covers topics such as:

The Series 66 test, or the Uniform Combined State Law Examination, is a test that combines the content of the Series 63 and Series 65 exams. It is designed for anyone who wants to be both a securities agent and an investment adviser representative in a state.

In the Series 66, candidates are given 100 multiple-choice questions and 150 minutes to finish. Takers need to score at least 73%, or get 73 questions correctly to pass. The test covers topics such as:

Exam | Series 63 | Series 65 | Series 66 |

|---|---|---|---|

Purpose | Securities Agent State Law Exam | Investment Adviser Law Exam | Combined State Law Exam |

Prerequisite | None | None | Series 7 (co-requisite) |

Time limit | 75 minutes | 180 minutes | 150 minutes |

Questions | 60 | 130 | 100 |

Passing score | 43/60 (72%) | 92/130 (70%) | 73/100 (73%) |

Cost | $147 | $187 | $177 |

Source: FINRA (Data as of August 9, 2023)

In terms of Series 65 vs 66 difficulty, both exams are quite similar. But there are some key differences in the structure and content covered by each exam. Let’s dig in:

The Series 65 has 130 questions and is 180 minutes, which means you have 1 minute and 23 seconds to answer each question. The Series 66 is 100 questions and 130 minutes long, which means you have 1 minute and 18 seconds to answer each question. 5 seconds per question isn’t a huge difference, but when you compound it over the whole time period, it adds up to a couple of extra crucial minutes that you can use.

And on the other hand, the Series 65 is longer. Longer tests are simply harder, both for fatigue and because the test will cover more topics.

In terms of content, the Series 65 includes more questions related to investment products, suitability, and economics. These topics are covered on the Series 7 as well, so in many ways the Series 65 includes a “mini Series 7” inside to ensure you’ve mastered these concepts. Remember, the Series 7 is a co-requisite for the Series 66, but not the Series 65.

The Series 66 still includes the topics above, but is also heavily weighted toward state laws and investment adviser regulation. Some consider the Series 66 to be a ‘combination’ of the Series 63 and Series 65 due to this, but that’s not entirely the case because the Series 65 covers more in the topics mentioned above than is covered by the Series 66.

Whether suitability and products (Series 65) or laws and regulations (Series 66) are easier is up to the individual, so we hope this helps you understand which test will be better for you.

Each of these exams is tied to – and required for – different career paths. These paths can be a bit hard to digest, so we walk you through the career path of each exam below:

First, it’s important to note that the Series 63 alone is not enough to be able to perform a licensed role. If you obtain your FINRA SIE, Series 6, and Series 63 licenses, it will allow you to facilitate transactions of investment companies and variable annuity products. This is the typical licensing path of someone who works on the sales side of an insurance broker that does not handle wealth management.

If you obtain your FINRA SIE, Series 7, and Series 63 licenses, this will allow you to facilitate transactions of virtually all securities products. This is a typical licensing path for someone who works in sales at a wealth management advisory firm and is only dealing with in-state clients.

In the two scenarios we listed above (SIE + 6 + 63; or SIE + 7 + 63), if you add the Series 65 to your licensing repertoire, then you will also be able to provide advice with the associated securities. Someone who has the SIE, 6, 63, and Series 65 can provide advice on investment companies and variable annuity products. Someone who has the SIE, 7, 63, and Series 65 can provide advice on virtually all securities products.

The Series 66 is effectively a combination of the Series 63 and Series 65, so if you’re planning to get both of these licenses, it might be preferable to get the Series 66 license instead.

– Achievable, 2023

Given there are so many paths for the Series 63, the jobs using this license range from customer service and trader positions (which will require the SIE and Series 6 or Series 7) to investment adviser and financial planner (which will require the Series 65 in addition).

The Series 65 is the only license and exam that is “standalone”, in the sense that it has no prerequisites and does not require sponsorship to register and take. A person that passes the Series 65 can act as an investment adviser representative, which gives them the ability to give investment advice and sell advisory products. As mentioned above, to facilitate the transactions of securities products in addition to the advisory products, you will require either the FINRA SIE and the Series 6, or the FINRA SIE and the Series 7 licenses.

The primary career paths related to the Series 65 license are investment advising and financial planning.

The Series 66 is a gateway to dual registration as both an insurance or securities agent, and as an investment adviser representative. It is effectively considered a combination of the Series 63 and Series 65 by the NASAA. The “Series 63 portion” of the Series 66 allows the candidate to act as an agent, if they also have the necessary FINRA SIE and Series 6 or Series 7 licenses. The “Series 65” portion of the Series 66 allows the candidate to act as an investment adviser representative and give investment advice.

As with the Series 63, when you couple the Series 66 with the FINRA SIE and Series 6 licenses, you can facilitate transactions and provide advice on investment companies and variable annuities; and when you couple the Series 66 with the FINRA SIE and Series 7 licenses, you can facilitate transactions and provide advice on virtually all types of securities products.

The primary career paths related to the Series 66 license are investment advising and financial planning, typically in addition to a wealth management or securities sales role. Many people take the Series 66 after they have already been working in a Series 6 or Series 7 licensed role in order to expand their offerings to include investment advice.

We hope this gives you some clarity on what career paths are available to you with each of these three NASAA exam licenses. Now let’s cover how to prepare.

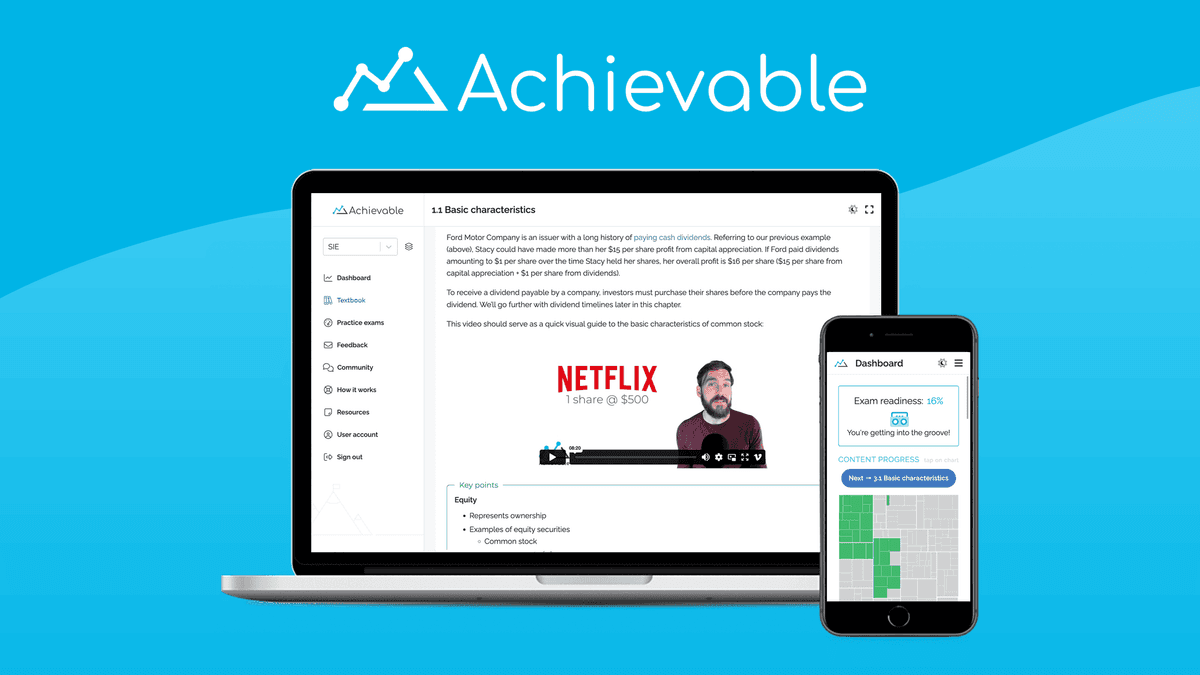

Once you have a test date locked in (aim for at least a month out), it’s time to prepare for the exams. As a starting point, refer to the official outlines provided by NASAA (Series 63 outline, Series 65 outline, Series 66 outline). After that, there are many resources you can use to prepare, such as the online courses offered by Achievable.

You might also want to join study groups and get valuable input from people who’ve taken the tests before. You should also plan your study schedule ahead of time and review the material frequently, so you don’t get flustered come exam time.

These securities exams, Series 63, Series 65 vs. 66, are not easy. However, they are not impossible either. All it takes is the right amount of preparation, dedication, and time—all of which is within your control. It’s up to you to determine which exam you’ll need for the career you want. Good luck!

Several FINRA and NASAA test concepts related to retirement plans, securities regulations, and IRS rules are changing in 2023. Good news – the Achievable team has you covered! Learn more about the updates to our courses here.

Achievable is committed to providing the most current and comprehensive education resources for FINRA and NASAA exams. As a part of this, we’re updating all our FINRA and NASAA prep courses to align with the recent amendments by the Securities and Exchange Commission (SEC) regarding the T+1 settlement cycle. What is Settlement? You probably already …

A complete walkthrough of how to get sponsorship for Series 7 licensing, including what sponsorship means, how to apply, Form U4, and what to do if you can’t get sponsored.