So, you’re thinking about what to do after college – does becoming a financial advisor seems like an attractive proposition? Do you have a general interest in the stock market? Perhaps you’ve heard of financial advice as a career, but you’re not sure exactly what that involves? Or perhaps you’re deciding between finance and a coding bootcamp? Read on – our guide is here to be a resource on the position and to outline what you can expect.

Wealth management is a sector where careers are projected to grow faster than the market average over the next several years, according to the U.S. Bureau of Labor Statistics. In fact, the growth rate predicted between 2016 and 2026 is 15%, much faster than average.

With attractive job prospects and great pay (the average annual salary of a financial advisor coming in at $90,640 or $43/hr in 2018), it’s easy to see why this has been a popular career choice for college graduates and career-switchers alike for decades.

It can be a rewarding career as well, both financially and in terms of job satisfaction. If you enjoy helping people, you’ll get to help people from all walks of life manage and grow their wealth.

Wait, help people? Isn’t wealth management just about helping rich people get richer?

Well, it can be – but it doesn’t have to be. You’ll encounter all sorts of people with different circumstances, and different needs to improve their financial situation.

Like somebody who has had a life-changing injury and been awarded a substantial compensatory sum of money. You can help them take that money and invest it so that they can adjust to their new circumstances while being secure in their long-term financial situation.

Or the elderly couple who’ve saved for retirement all their lives – you can help them get the most out of their retirement savings for their future – and their children’s future.

Personal financial advisors assess the financial needs of individuals and help them with decisions on investments such as stocks and bonds. Advisors help clients plan for short-term and long-term goals, including education expenses and saving for retirement, through investments and wealth management strategies. They then invest their client’s money on their behalf based on the client’s decisions. Many advisors also provide tax advice or sell insurance as part of their repertoire.

Financial Advisors complete a number of different tasks on any given day. One of their most common, and important, tasks is meeting prospective clients face-to-face. At these meetings, an advisor will usually:

Advisors also conduct review meetings with existing clients where they might:

In order for these meetings to be effective, Financial Advisors spend quite a lot of time preparing for meetings and doing administrative and back-office tasks. These include:

They also spend a lot of time on training, also known as continuous professional development. This includes tasks such as:

It takes great time management and organizational skills to be able to keep up with all of the tasks required to be a successful adviser. In fact, let’s take a look at the skills you’ll need to be an outstanding financial advisor.

The table above shows the “four skill domains of financial advisor mastery” developed by Michael Kitces, an established financial planning expert. He notes that it’s important to distinguish between client-centric and business-centric skills. Financial advisors have to succeed in each of the following four areas for their business to flourish:

Sales (Business Development)

Management (Business Execution)

Empathy (Relationships)

Competency (Technical)

Sales

Sales skills are essential in many careers, and they are fundamental to being a successful Financial Advisor. You’ll need sales skills to be able to get clients through the door, as well as to keep them there. All of the analysis in the world won’t help you be successful if you can’t close the sale with the client.

Fundamental sales skills include:

Sales skills can be taught (and should be taught at your firm – ask about this), but the best way is to learn them by practicing them. Focus on one of these skills at a time and keep track of your progress, either quantitatively (number of prospects sourced) or qualitatively (how was my active listening today?). If possible, work with your manager or training program to maximize this training.

You should also learn by observing other advisors at your firm and how they operate. Ask your more experienced colleagues if you can listen in on a call where they’re doing something you’re looking to improve, like closing a sale. Be sure to go into those “listen ins” with specific questions in mind: How does the salesperson open the closing conversation? How do they handle objections about our advisory rate? Et cetera.

Management

As a financial advisor, you’ll need relationship management and time management skills to be able to manage your clients effectively and ensure that you are keeping their portfolios at peak performance.

There’s also a need for effective general management within Financial Advisory firms. The median size of firms has been growing over the last two decades, and because business management skills weren’t traditionally necessary among Financial Advisors, there’s a shortage of skilled managers within a lot of firms.

General management skills include:

Some of these skills, like communication and planning, are key parts of a financial advisor role. Others, like delegation skills and performance management can be learned. Good ways to gain these skills if you don’t yet manage people are reading books on management and taking relevant courses. You can take free management courses online with various providers, including Harvard and Coursera.

In the future, more emphasis is likely to be given to developing advisors management skills alongside their sales skills. Both in order to plug this growing skills gap in the industry, and because financial advisors are expected to handle more clients at once than before.

Empathy

One of the main reasons that there is still demand for personal financial advisers in times of low-cost, automated, and fully online versions is the empathy traditional advisors are able to provide. In general, a good relationship between financial advisor and client is crucial:

“My colleagues and I agree that 80 percent of our job is psychology, and only 20 percent is financial. I know successful owners of financial advisory firms that specifically recruit psychology majors for this reason. Though a business or economics degree will better prepare a professional to take industry exams or explain financial products, the ability to understand the core concerns and goals of a client or prospective client is much more valuable.”

– Financial advisor Eric Schaefer in an interview for US News ‘Best Job Rankings’

However, some feel like these important interpersonal skills are not stressed enough in training. Tania Brown, for example, described his experience of the financial advisor training like this: “[…], I realize how many advisors want to help their clients but remain chained to a compensation structure that only pays if they sell a product. There is so much focus on selling that advisors aren’t always equipped to look at the entire financial picture to make sure that their recommendations are the best fit.”

This means that, depending on your desired approach, you might want to ask prospective firms about how much they value empathy and satisfaction of existing customers versus the acquisition of new customers. This is a great interview question for your prospective employer that helps you understand your values before you work there.

Competency

Clients need to be able to trust their Financial Advisor with their money, so it’s crucial that they demonstrate absolute competency. The advisor must be able to collect, analyze and synthesize information about the client, and information about investment products to be able to provide sound advice.

Math skills are an obvious must in terms of competency, and the ability to analyze large amounts of numerical information. It’s also important to analyze the client’s attitude to risk so that appropriate products and funds can be chosen that complement the client’s risk profile.

Technical competency is initially assessed by relevant FINRA exams that need to be studied for and passed before you can provide financial advice. In order to educate investors on how important competency is, in October 2017 they issued an investor alert to help investors identify which advisors genuinely hold the most relevant qualifications.

What if I don’t have all of these skills right now?

If you don’t believe you meet the requirements of all of these categories, fear not! People almost never have all of these skills mastered the day they start as a financial advisor – they are acquired and improved over time with thoughtfulness, dedication to training, and hard work. Your success really depends on you and tapping into what interests you about the role. Being passionate about financial advice is the glue that holds it all together (and being passionate about the money you’ll make doesn’t hurt!). These are guidelines, not requirements: You grow with your challenges. Speaking of which..

Wealth Management since the 2008 Financial Crisis

The financial crisis of 2008 rocked the industry. When the mortgage market collapsed and millions of Americans saw their savings lose almost half their value overnight, their confidence in the finance industry was badly damaged.

The crisis was caused by a surge in subprime mortgage lending and exacerbated by financial services providers bundling financial products together to allow for looser underwriting criteria. Aggressive marketing of these products increased subprime borrowing even further. As more and more subprime financial products were sold, the default rates rocketed.

The rising default rates meant that banks who had invested heavily in these products experienced liquidity problems and eventually required a government bailout to prevent them from going bankrupt. The resulting impact on the stock market meant that people saw their investments shrink dramatically.

The reasons behind the crisis were widely debated in the national and international press, but the underlying feeling was that better regulation would have prevented the crisis. If financial institutions had been held more accountable for their corporate governance and risk management, then the crisis may have been avoided.

The US government acted swiftly and implemented stricter regulation and penalties for financial services companies. In July 2010, the Dodd-Frank Act was signed into federal law. It provided widespread and significant changes to the financial services industry.

The Act provides rigorous standards and supervision to safeguard the economy, consumers, investors and businesses. It ended government bailouts of financial institution; provides for an advanced warning system on the stability of the economy; creates new rules around corporate governance; and eradicates the legal loopholes that led to the 2008 economic crisis

With robust regulatory practices now in place, people’s trust has returned and since the crisis, they are turning to experts to help invest their money wisely. As Kyle Kensing, Online Content Editor for CareerCast puts it: “People are starting to plan more aggressively in case something else happens.”

Current Challenges

Although there’s a lot of demand for professional financial advice and the pay is good, there are some challenges for those working in the industry today. Successful advisors are rising to these challenges by keeping abreast of new technologies as they become available, and by offering more specialized and personal services. Some of the key challenges Financial Advisors currently face are:

Client Expectations and Market Volatility

Clients may have an expectation that investing will make them a lot of money, and yet those same clients may not be willing to take the risks that are often required to reach high yields.

You can help manage those expectations by explaining risk versus reward. All investments have some degree of risk. The general rule of thumb is that higher risk = higher potential return. To make this even clearer, you also need to highlight that the risk of this is that the returns could potentially be low, non-existent, or the investment could even lose money.

Educate the client on market volatility and advise how you recommend investing to mitigate potential risks Your role as an advisor is to identify how willing a client is to take the potential risks, and to ensure they understand the risks involved.

On the flip side, some clients may be very nervous about investing as they are aware of market volatility.

An advisor’s role is to manage those fears or expectations by educating the client about volatility, and how it can be managed with strategies like asset diversification. The ultimate aim is to put plans in place that will meet the client’s long-term financial goals while matching their risk profile.

Government Regulations

Financial Services is a heavily regulated industry, where regulatory changes happen frequently.

For instance, one of the most recent changes occurred in June 2017, when the Department of Labor began phased introduction of a new fiduciary standard rule. Full implementation of the rule is expected to come into play on July 1, 2019.

The fiduciary rule is designed to ensure that advisors act in the best interests of their clients when dealing with retirement accounts, including that they clearly disclose all fees and commissions to them. It expands the definition of fiduciary to include any person making a recommendation or solicitation in a professional capacity and includes brokers, insurance agents, and planners.

When the new rule fully comes into force, it is expected that the commission-based fee structures that most firms currently use will be replaced with a flat fee based structure. This shows how much can change based on regulation – your whole compensation arrangement could need to change with just one shift in a definition.

Advancing Technology

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. The industry has grown to $60 billion at year-end 2015 and is projected to reach $2 trillion by 2020 – a tremendous increase in adoption in a short period of time.

The main advantages of robo-advisors are:

Even so, financial advisorship still offers strong career prospects in the future – remember the above-average job growth in the next 10 years. While robo-advisors are ideal for younger investors with less experience or financial assets, they can hardly manage advanced services like complicated tax management, estate planning, trust funds, and retirement planning.

They also lack empathy and sophistication, and are not fully trusted by consumers: according to a study conducted by Investopedia and the Financial Planning Association, 40% of participants stated that they would not use robo-advisors during extreme market volatility.

It remains to be seen how the industry develops and whether or not continued innovation will manage to eliminate these shortcomings. In the meantime, know that by maximizing those advisor skills of Empathy and Sales, you can probably do very well regardless.

We all live in times of unprecedented change, and the key to thriving in Financial Services is the same as in all industries: work hard at both the day-to-day and improving your skills over time, keep yourself up to date on new technologies and government regulations, and learn to embrace change and adapt it to your business.

Many of the listed challenges are easily turned into opportunities when you apply the right mindset.

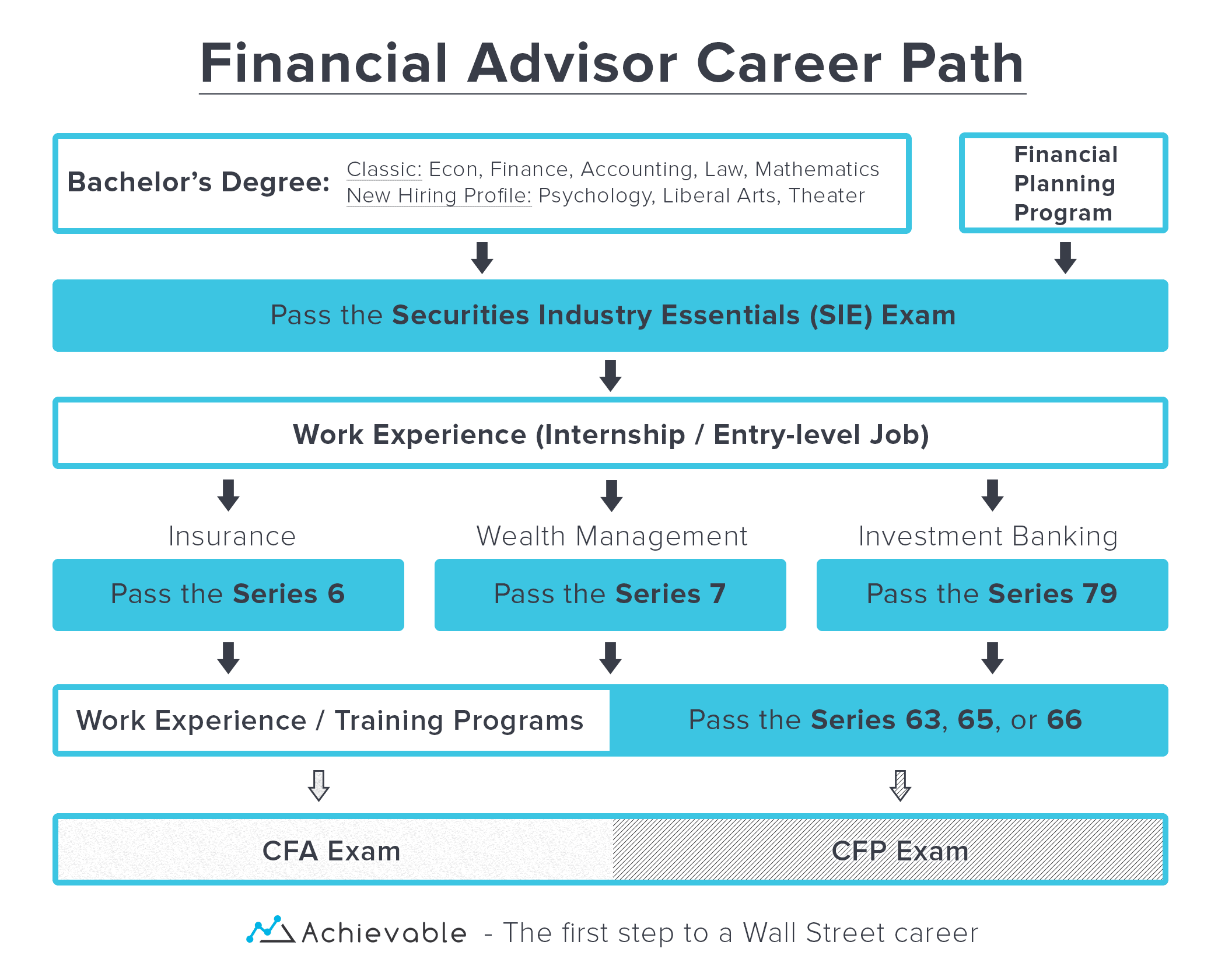

So you want to be a financial advisor? Here’s a chart laying out the way the role progression looks for a typical financial advisor:

College degree, or: “What you do before you apply to your first financial advisor job”

The typical entry path to becoming a Financial Advisor is a bachelor’s degree. Any degree discipline is generally accepted, but degrees in finance, economics, business, accounting, and statistics are particularly favored. Candidates with a psychology degree are also good instead, as the analytical skills plus the insight into people’s behavior will help them in the role.

There are even specialized programs in financial advising at some colleges. However, there’s no stipulation that your degree must be in one of those subjects, it will simply put you at an advantage.

Pass the Securities Industry Essentials (SIE) exam

The FINRA entry-level exam structure changed recently in October 2018. A new exam, the Securities Industry Essentials (SIE) exam, has replaced large and often overlapping portions of the previous exams. FINRA wisely decided to consolidate a lot of the overlapping material into a general exam that essentially serves as the ‘first half’ of the Series 6, 7 and 79 in one test. Then, he Series 6, 7, and 79 exams have become “top-off exams” that build on the foundation of the SIE and are focused on topics in your specific vertical.

The great thing about the SIE is that you won’t need sponsorship from a FINRA member firm to take the exam, so you can do this before you even apply to work at a firm. This is a great way to boost your resume before applying.

Getting a job in finance

Now that you’ve passed the SIE and gotten your resume in order, it’s time to go get that job in finance. Hands-on experience is crucial when early in your wealth management career, and the earlier the better. Whether you decide to do an internship or spend a couple years in an entry-level role, nothing is more valuable than spending some time in the actual workplace and finding out if the industry suits you.

To get into an entry-level position, you’ll need to pass the interview. Here is what you can expect and some tips on how to ace a finance industry interview:

Acing the finance industry interview

Finance industry interviews are a bit notorious, but don’t let that discourage you from applying. For every bad story posted online, there are hundreds of normal ones that did not merit any followup. That said, the interview process is meant to be rigorous – you are expected to have prepared for the interview and to be professional throughout the process.

You’ll be asked some behavioral interview questions, which are questions that require you to relate a past experience. For example, “Tell me about a time when you have persuaded somebody to make a purchase.”

You may also be asked about your knowledge of current regulatory requirements, so make sure you have a decent understanding of the basics before the interview. Passing the SIE ahead of time will help cover this, but you should still do your own research.

You’ll almost always be asked what you know about the company and why you want to work there, so spend time preparing for these questions. Look at their typical client base, their market share, and their reputation for career progression so that you can provide thoughtful answers.

Some questions you may come across in an interview for a trainee financial advisor position are:

Tell me how you will establish rapport with prospective clients.

How do you make sure that you achieve your goals?

Describe a situation in which you talked somebody around to your way of thinking.

Do you consider yourself conservative or a risk taker?

How do you stay current on tax and investment laws and regulations?

Where do you see yourself career-wise in five years, and then ten years?

Passing the entry-level Series 6, 7 or 79 top-off exams

The Series 6, 7, and 79 are the main entry-level exams that you may be expected to take while in your entry-level position. If you have not yet taken your SIE exam, you’ll be expected to pass it quickly, and then depending on your role you will likely be quickly asked to pass the following top-off exams:

There are a whole host of financial exams that you will need to take throughout your career. Which ones you take will depend on your chosen career path and the regulatory requirements for that path. They are all administered by the Financial Industry Regulatory Authority (FINRA).

In order to take all FINRA exams after the SIE, you must be sponsored by a financial firm that is a member of FINRA.

Series 6: Series 6 (also called the “Investment Company / Variable Contracts Products Limited Representative” exam) is a security license, which enables you to register as a limited representatives and therefore sell mutual funds, variable annuities and insurance premiums. However, the Series 6 does not enable you to sell corporate or municipal securities, direct participation programs and options.

Series 7: The Series 7 (also known as the “General Securities Representative Exam”) is the general securities registered representative license, which entitles you to sell all types of securities products (except for commodities and futures). The exam mainly focuses on investment risk, equity and debt instruments, options, taxation, packaged securities, retirement plans and interactions with clients.

The Series 7 is a standard requirement for an entry-level broker.

Series 79: The Series 79 (also called “Limited Representative Investment Banker’s exam”) is necessary for those planning on working in the investment banking field. The Series 79 was created by the SEC in 2009 in order to better examine entry level investment bankers. Not everyone requires the Series 79. Generally speaking, if you deal in either of these two areas, you might require the Series 79:

1) debt or equity offerings through public or private placement

2) mergers, acquisitions and financial restructuring

Once you have the entry level exams under your belt, you can start to think about where you want to take your career in the longer term. There are various routes, including technical, sales and business development, and management.

There are two common options for professional certifications, and which one you choose will depend on the aspects of your career you have enjoyed most so far.

CFP & CFA

CFP stands for ‘Certified Financial Planner’ and puts you on the investment career path, enabling those who pass the exam to advise individual investors.

The CFP exam trains students to create and apply financial plans for clients. In order to take the CFP exam, you need to have a bachelor’s degree, three years of work experience in financial planning and additional education in one of these areas: insurance planning, financial planning, retirement planning, income taxation, estate planning, investments.

Most professionals with CFP certifications work directly with clients, so if you enjoy this aspect of financial advising then this is likely to be a good option for you.

CFA stands for ‘Chartered Financial Analyst’ and is an internationally recognized certification which is the equal to holding a master’s degree in finance. The CFA is issued by the CFA Institute (link behind) and anyone with a Bachelor’s degree may take the exam. However, it is extremely difficult (the pass rates are generally below 55%).

The CFA consists of three tests, mainly covering financial analysis and ethics. Many CFAs work as financial analysts, in more behind-the scenes roles rather than working directly with clients.

If you prefer analyzing rather than face to face meetings with clients, then this could be a great direction to take.

You can build your portfolio and suite of available products by taking other FINRA exams to allow you to sell a wider range of services and products.

Series 63: The Series 63 exam is required in most states. It is the minimum examination required to satisfy state laws. The test consists of 65 questions and about 85% of brokers pass on their first attempt.

The Series 65 is a bit different. The majority of those who take the Series 65 are either securities professionals who failed the Series 7, or professionals who are already working in the finance industry (e.g. accountants) who want to provide investment advice for fees. The exam takes about 3 hours and covers a wide range of topics, such as economics, investment vehicles, investment strategies and ethics. The Series 65 enables a professional to act as an IAR (investment advisory representative) and meets the requirements for state registration.

The newest exam is the Series 66. It is basically a combination of the Series 65 and 66, and you must have passed the Series 7 to sit it.

Wealth management is a challenging but rewarding career and an area that is due to see substantial job growth over the next ten years. Starting a career in wealth management has been simplified even further with the introduction of the new FINRA SIE exam in October 2018, which you can study for even before you are employed by a FINRA regulated firm.

A successful career as a financial advisor involves plenty of planning and hard work, but the career prospects and earning potential are incredible. It’s a great time to build your career in financial advice, and you can start preparing and planning for even before you leave college to give you a head start.

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

Unsexy but mighty, bonds represented $39T in net value WW in 2015, while stocks were worth approximately $26T. Basic Wisdom’s Brandon Rith walks you through how they’re handled in the wealth management profession.