Are you having trouble distinguishing the different order types for a FINRA or NASAA exam? You can easily understand how market orders, limit orders, and stop orders work with some real world analogies. As a finance instructor for over a decade, I find most learners over-complicate these topics.

This is the most basic order type. When an investor places a market order, they request a purchase or sale of a security at the next available price. The investor is guaranteed to buy or sell the security, but the execution price is unknown. Investors place market orders when they want a transaction done as soon as possible without regards to cost.

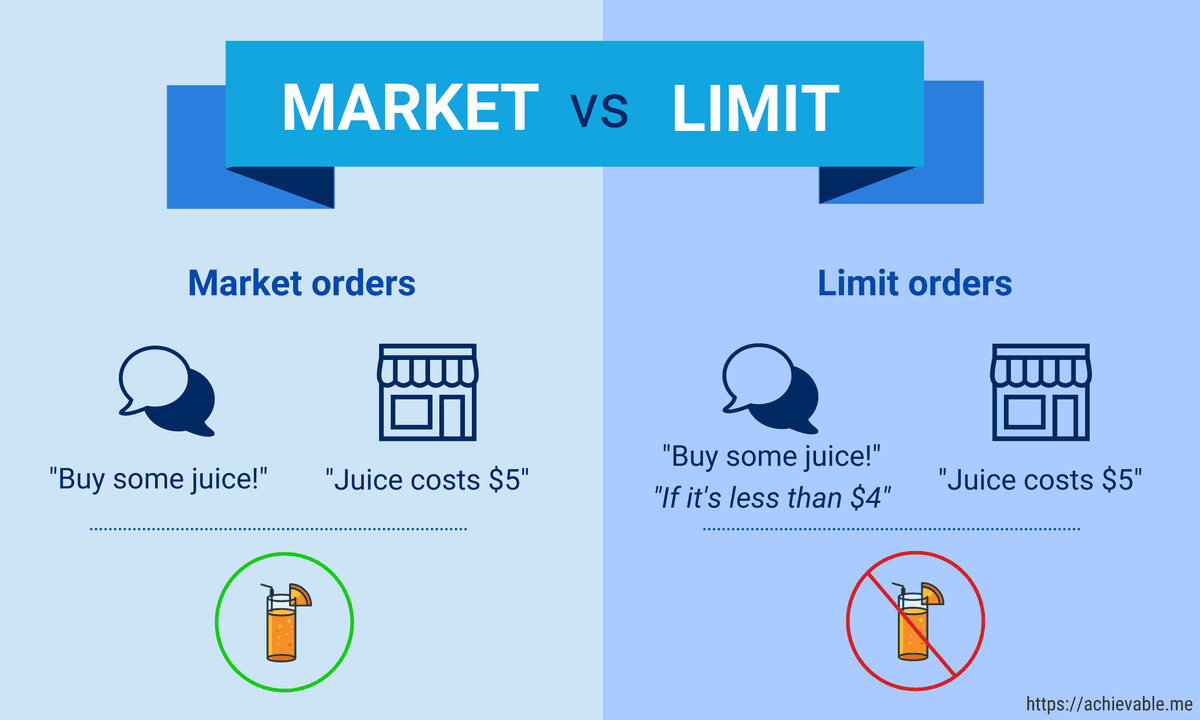

Assume your partner says the following: “go buy some orange juice because we’re out!” Your partner just gave you a buy market order for orange juice. They want orange juice and didn’t mention anything about price. You’ll bring home orange juice, but it’s possible you paid a high price.

Learn more about market orders in our Achievable Series 7 course. You can view a few pages for free, or try some sample Series 7 questions to get a feel for it.

When an investor wants price “limits” on a transaction, they place limit orders. Buy limit orders specify the highest price the investor will pay for the security, while sell limit orders specify the lowest price the investor is willing to sell the security for. If the price of the security is not within those limits, the order is not executed.

Assume your partner says the following: “go buy some orange juice, but only if it’s $4 or less.” Your partner just gave you a buy limit order for orange juice. They want orange juice, but only if it’s $4 or less. It’s very possible you don’t come home with orange juice if it’s too expensive.

So, how are limit orders and market orders different? Market orders guarantee execution (the orange juice will be bought no matter what), but not price. Limit orders guarantee price (the orange juice will not be bought for more than $4), but not execution. These are very important concepts to remember when comparing a market order vs. limit order.

Learn more about limit orders in Achievable Series 7.

Stop orders might seem a little backwards upon first glance. A buy stop order purchases a security at a price higher than the current market price, and a sell stop order sells a security at a price lower than the current market price. While it may seem counterintuitive, these orders are used for very specific purposes.

Assume your partner says the following: “we have orange juice that we bought for $4, but you should buy some more if the price is $6 or more; that probably means there’s a shortage!” Your partner just gave you a buy stop order. If the price of orange juice has risen, it might be a sign of unexpected demand. It’s probably best to stock up!

So, what is the difference between a limit order and a stop order? Both specify price, but in two different ways. Limit orders are utilized to ensure an investor doesn’t overpay for a security purchase or get underpaid for a security sale. Stop orders buy securities when prices rise and sell securities when prices fall. This highlights the primary difference when performing a limit order vs. stop order comparison.

Learn more about stop orders in Achievable Series 7.

If a stop order is utilized as a hedge (protection), it’s referred to as a stop loss order. For example, assume you own shares of stock at $50. If you were concerned about the stock price falling but didn’t want to sell the stock immediately, you could place a sell stop order at $45. This allows for continued growth if the market price rises. However, the sell stop order executes if the market price falls to or below $45, effectively “stopping” any further losses.

Learn more about stop loss order in Achievable Series 7.

Continuing with our previous example, the stock would be sold if the market price falls to or below $45. When this occurs, the order “triggers,” which means it transforms to something else. In particular, stop orders become market orders when they meet their price specifications (trigger). If the market price were to fall to or below $45, the order would become a market order, which executes at the next available price. Remember, market orders do not have any price specifications, so the order could actually be executed below, at, or above $45.

Learn more on how a stop order works in Achievable Series 7.

Some investors are concerned about how stop orders eventually become market orders when they’re triggered. Given they do not have price specifications, market orders can potentially execute at a very high or low price in a volatile market. A stop limit order solves this problem. In simple terms, the only difference between a stop and stop limit order is what happens after the trigger. When the trigger occurs, the stop order transforms into a limit order instead of a market order. Let’s use the previous example to compare a stop limit vs. stop loss order.

First, let’s reset. You own shares at $50 and are worried about the price falling. You could place a sell stop order at $45 or a sell stop limit order at $45. We already know what occurs with the stop order. When the market price falls to or below $45, the order becomes a market order and sells the stock at the next available price, which could be below, at, or above $45.

Now, let’s explore the sell stop limit order example at $45. The order starts the same; it will only trigger if the market price falls to or below $45. When this occurs, the order triggers and becomes a sell limit at $45. Remember, sell limit orders only execute if the market price is at or above the limit price. In order for the order to be executed, the market price must be $45 or higher. This ensures the investor will not sell their shares for less than $45.

A buy stop limit order works the same way, but backwards. If a buy stop limit at $55 is placed, the market price must first rise to or above $55 to trigger. Once the trigger occurs, it becomes a buy limit at $55, which only executes if the market price is at or below $55. Stop limit orders are tricky orders that may require the market to go up, then back down (or vice versa).

You may be wondering about the difference between limit and stop limit orders. Limit orders are a one step order with a price specification. For example, a buy limit at $55 only requires the market price to be at or below $55 for the order to execute. A buy stop limit order at $55 essentially is two orders at once (stop and limit together as one order). The market price must rise to or above $55 to trigger (this is the stop), then it will execute if the market price is at or below $55 (this is the limit).

Learn more about stop limit orders in Achievable Series 7.

I’m asked this question all the time: “can I place a stop loss and limit order at the same time?” The answer is yes, but in two ways. An investor essentially places both orders at once with a stop limit order, just like we just demonstrated in the last section. Also, an investor could place the two orders separately. To better understand this, let’s again assume you own shares at $50.

You could place a stop loss (sell stop) order at $45, which would sell the stock if the market price falls to or below $45. Again, this order prevents future losses, which is why we call it a “stop loss” order. Additionally, the investor could place a separate sell limit order at $55, which would sell the stock if the market price rises to or above $55.

The investor creates a “bubble” for their stock if the market price stays above $45 and below $55. Meaning, the stock will not be sold if it stays in that range. If the market price falls to or below $45, the stop triggers and the order executes, getting rid of the stock prior to it falling too far in price. If the market price rises to or above $55, the investor locks in a gain.

Review tricky order types in Achievable Series 7.

If you’re looking for additional material and practice questions regarding these topics, check out Achievable’s SIE Exam and Series 7 Exam programs. Thanks for reading!

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

Unsexy but mighty, bonds represented $39T in net value WW in 2015, while stocks were worth approximately $26T. Basic Wisdom’s Brandon Rith walks you through how they’re handled in the wealth management profession.