From highlighting different spoken languages to promoting your excellent soft skills, here are 13 answers to the question, “What are your most effective tips that help a resume stand out when applying for a job in finance?”

A great example of an intangible skill to highlight on your resume is having foreign language proficiency. Demonstrating foreign language proficiency in your background gives employers the impression that you are well-versed in working with diverse cultures and being able to converse with potential colleagues and clients abroad.

This is something that will not be as common in resumes compared to technical skills, like financial modeling or analyzing data, making it a valuable asset when applying for any finance position.

Tasia Duske, CEO, Museum Hack

The “summary resume” is an inappropriate format for those looking for jobs in finance and accounting, yet I think many people still get it written for them.

I have found that every single hiring manager favors a resume written in reverse chronological order. So, start with the most recent and relevant job you’ve held and work backward. But be careful not to regress too much.

If you’re applying for a job, only include employment history from the last 10 years on your CV, even if it stretches back to the ’90s. For the interview, you can discuss topics that are far further back in time.

Gerrid Smith, Chief Marketing Officer, Joy Organics

You can have the best qualifications for a job in finance, but if your resume doesn’t get past their applicant tracking software (ATS), then it will most likely never stand out to be reviewed. So, you need to input keywords and factors.

The purpose of a resume is to motivate the recruiter to give you an interview, and since many firms are now using sophisticated recruiting software to identify candidates, the algorithms must notice you.

Researching their job descriptions, identifying keywords and long-tail phrases, and inputting relevant job structures into your resume can make you more identifiable to ATS. In addition, making it easy to read will help those algorithms crawl your resume.

Making efforts to trigger ATS algorithms will highlight you to job recruiters, which will give you a better chance of standing out to get that interview.

David Derigiotis, CIO, Embroker

David Derigiotis, CIO, Embroker

Having errors like misspelled words or awkward sentence constructions on your resume will only hurt your chances of getting an interview. When reviewing your resume, hiring managers will immediately notice any grammatical errors.

Don’t trust spell and grammar checks since they may overlook things like subject-verb disagreement, inconsistent tenses, incorrect punctuation, and terms like “were” when you meant “where.” A CV that has been printed and read aloud is the best way to catch typos. The next step is to have someone who is fluent in English read over it.

Max Whiteside, SEO and Content Lead, Breaking Muscle

When you create a resume for a job in finance, it’s important to tailor your content and format specifically to the company and position. Before you write, thoroughly research the organization and the job description. This will give you a better understanding of what they are looking for in an ideal candidate and help you focus your qualifications on those requirements.

Once you have a clear idea of what they are looking for, you can use that information to properly communicate your strengths and showcase the skills necessary to be successful in the role. Additionally, consider using relevant industry vocabulary and keywords in your resume to show that you understand the finance sector. Doing this will show hiring managers that you have advanced knowledge of the industry and could be a valuable asset to their organization.

Asker Ahmed, Director and Founder, iProcess

If you want your resume to stand out, highlight relevant achievements and results using concrete evidence of your financial expertise, i.e., numbers. Present quantifiable achievements, such as increasing profits, reducing costs, or improving financial processes that you achieved with your knowledge, skills, and experience.

Use specific and quantifiable data. Instead of “reduced expenses,” you could say “reduced expenses by 15% by implementing cost-saving measures such as technology solutions.” Additionally, focus on the impact you made. Emphasize that you worked not only to “increase profits” but “increased profits by 25% through effective budget management.”

Presenting concrete proof of your skills, testify that you can be a valuable asset who can bring tangible results to the organization. But always ensure the numbers and results you include apply to the job you are seeking.

Nina Paczka, Community Manager, Resume Now

Nina Paczka, Community Manager, Resume Now

This tip applies specifically if you’re going for a highly sought-after and/or competitive job at a well-known company, as your resume isn’t just seen by one person and then passed to the boss with a smile or discarded into the trash with a frown.

From our conversations and dealing with Cornerstone in our research for our business automation tips, we found a ton of useful information about parsers. Resume parsing allows larger companies to streamline the resume and applicant screening process. If you are applying at a larger firm, try to find out if they use this software, but if you can’t, always assume they do.

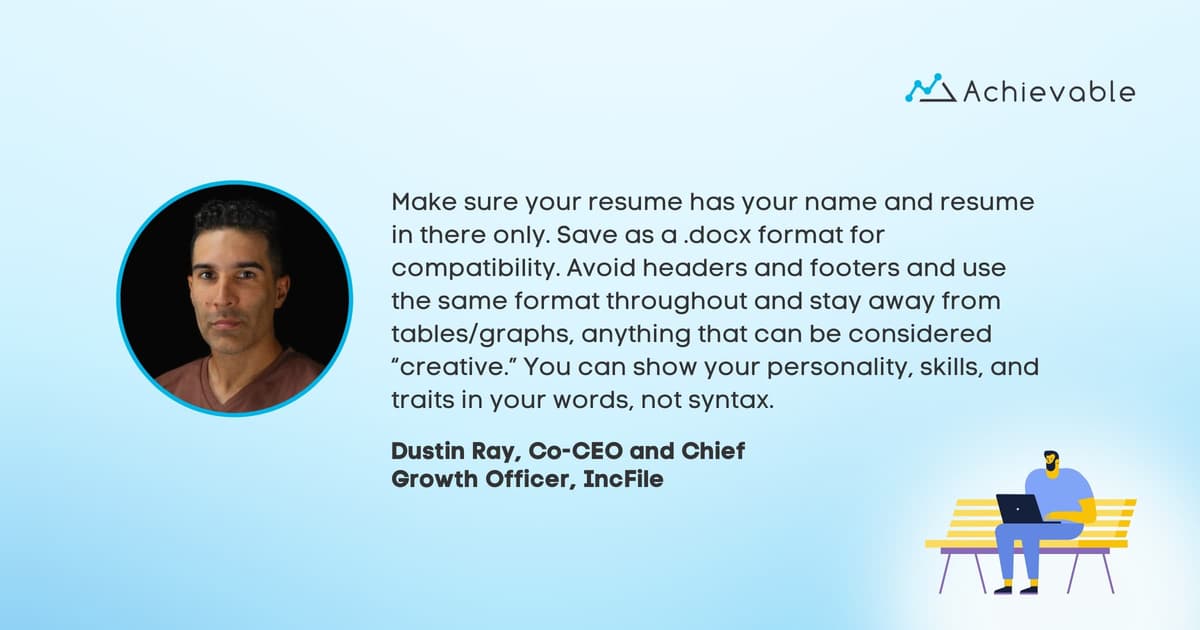

Make sure your resume has your name and resume in there only. Save as a .docx format for compatibility. Avoid headers and footers and use the same format throughout and stay away from tables/graphs, anything that can be considered “creative.” You can show your personality, skills, and traits in your words, not syntax.

Dustin Ray, Co-CEO and Chief Growth Officer, IncFile

It is important not only to list your responsibilities, but also to showcase your successes and advancements. Try your hand at producing condensed case studies with hard data. It’s OK to say that you “inspected accounting systems,” but you should also include a metric that shows how you increased efficiency or reduced costs for your company.

Have you worked on a software rollout or been in charge of establishing a new practice? Just how much money and effort did you save the business? If you provide results, you’ll show the hiring manager you know how to handle problems and understand the value of your position.

Kyle Bassett, Chief Operating Officer, Altitude Control

Sometimes, evaluating resumes leaves me with an overwhelming sense of déjà vu, especially when I’m placing a finance position. Candidates rarely appreciate just how similar their resumes look to other applicants. My top tip for standing out? Humanize your skills.

I know you’re good with numbers; that’s why you’re working in finance. Show me what else you offer. I want to know if you work well with others and how you lead in the office. Companies today are looking for employees who fit into their culture, so expand what you can bring to the table, and make sure you’re playing up your people skills.

Remember, data is only one part of the story; understanding how the bottom line relates to the company at large is a skill worth advertising.

Rob Reeves, CEO and President, Redfish Technology

Rob Reeves, CEO and President, Redfish Technology

This should come as no surprise, but many people take for granted the power of numbers. Especially on a finance resume, nearly every bullet point should have data about what you’ve accomplished. This is not the place for fluff, but for specifics on growth numbers, etc.

Kelli Anderson, Career Coach, Resume Seed

A few poorly answered questions can weaken a well-written resume. Get ahead of this problem by filling in any employment blanks or covering up any temporary job stints. Nobody is interested in hiring someone who frequently changes jobs. We should always handle a red flag.

A maternity contract, moving to a new city, taking maternity leave, or caring for aging parents are all examples of valid reasons for temporary positions. Assume nothing about your reader’s knowledge or ability to extrapolate. Despite how simple it may sound, resumes in the fields of accounting and finance should be proofread for spelling and grammar errors. My opinion is that it is crucial to pay close attention to details.

Timothy Allen, Sr. Corporate Investigator, Corporate Investigation Consulting

When applying for a job in finance, having an up-to-date resume that stands out can help you get noticed by recruiters and employers.

One tip to help your resume stand out is to highlight any financial certifications or licenses. This could include being professionally certified as a CPA, CFA, Financial Planner, or any other financial designation. Be sure to include any additional courses related to finance that you have taken and make sure the format of your resume is modern and professional.

Another tip to make your resume stand out when applying for a job in finance is to tailor it to the specific position you are applying for. Showing that you have done the research and tailored your resume according to the skills and requirements needed for the job will let recruiters know you are serious about being considered. Additionally, make sure to include any relevant experience you have in the finance industry, such as internships or previous positions.

Darren Shafae, Founder, ResumeBlaze

Darren Shafae, Founder, ResumeBlaze

When someone applies for a job in finance, it quickly becomes apparent whether they have the right qualifications, experience, and education for the role. We can easily verify these, and they are the minimum requirement for securing an interview.

If you’re sending a resume for a financial position at my company, I will expect you to have all the relevant credentials. If you don’t, I’ll find out quickly. So, we know you can do the math, but what else do you offer?

Soft skills are really important and are not always a focus for those in specialized professions such as finance. Logic, reasoning, and academic ability are helpful, but are you an excellent communicator? A problem solver? Can you adapt to meet new challenges? These are all essential abilities, especially if you’re working as part of a team.

A candidate who is well-rounded will often have the edge over someone who is purely technical, so showcase your soft skills as well.

Kathy Bennett, CEO and Founder, Bennett Packaging

Want to work in finance but don’t know where to start?We walk you through the two main ‘sides’ of finance, the buy side and the sell side, as well as which roles fall into each category and what kind of work they entail. Brandon Rith shares his knowledge of Investment Banking (IB), Private Equity (PE), asset management firms, and hedge funds.

Interested in careers in finance? In this post, we walk you through the different career paths in finance and securities to help you decide where you want to go.

A complete walkthrough of how to get sponsorship for Series 7 licensing, including what sponsorship means, how to apply, Form U4, and what to do if you can’t get sponsored.