When preparing for a FINRA or NASAA exam, “dump sheets” can be a big help. If you’ve never heard of them, dump sheets are study sheets you can memorize and recreate while sitting for the actual test. Of course, you can’t bring the sheet into the exam room, but you can write it out from memory onto your notepad when the test begins.

A dump sheet serves as a personalized reference guide, containing key formulas, concepts, or definitions that are most critical for your exam. This simple tool isn’t essential for success, but many test-takers find it invaluable for calming nerves and ensuring they have a quick go-to resource during the exam. And before the exam, dump sheets serve as a truncated note card that you can use to memorize key information. Here’s how dump sheets work, and why you might consider incorporating them into your study routine.

One of the main benefits of a dump sheet is psychological. Sitting for a big exam can be intimidating and having a dump sheet committed to memory helps alleviate the feeling of being overwhelmed. A dump sheet allows you to have the essentials at your fingertips, literally.

More importantly, the act of using a dump sheet can reinforce learning. Studies on memory and learning have long demonstrated that retrieving information from memory significantly boosts long-term retention. By memorizing and rewriting key information, you are actively engaging your brain in retrieving and organizing knowledge, thereby strengthening those neural pathways for test day.

Start by highlighting concepts and definitions you struggle with on paper or jotting them down. Summarizing and writing repetition force you to memorize complex topics in their simplest forms, enhancing retention. When studying, regularly refer to the dump sheet to reinforce your understanding and quickly identify areas on which to focus. Before exams, periodically rewrite the sheet from memory to further strengthen recall, making the material easier to retrieve under pressure.

Once you have committed your dump sheet to memory, you can quickly recreate it at the beginning of your exam. Most exams allow a few minutes for initial instructions or note-taking, and this is the perfect time to write out your dump sheet on your scratch paper or notepad. Now, instead of worrying about recalling key formulas or concepts under pressure, you have your reference guide at hand, leaving your brain free to focus on solving the actual problems.

Here are the links to printable and downloadable PDFs of Achievable’s FINRA and NASAA exam dump sheets, updated for 2024:

For more details about what is in each dump sheet, read on.

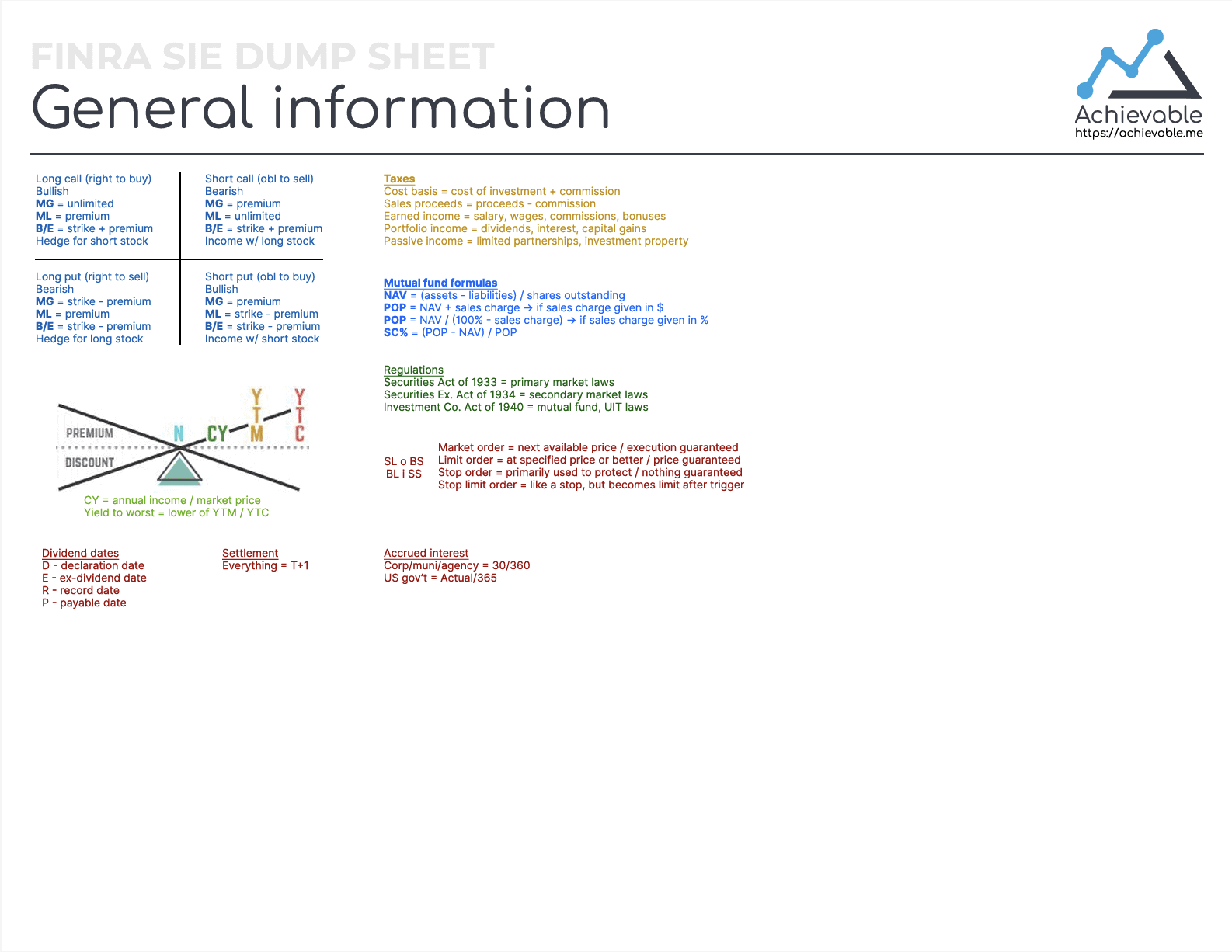

Achievable’s expertly crafted FINRA SIE, Series 7, and Series 65/66 general information dump sheets have helped over 95% of test takers pass their exams with ease. These powerful study tools cover all the essential information you need to succeed without feeling overwhelmed. Perfectly designed to reinforce your learning and calm your test-day nerves, they break down complex topics into simple, digestible pieces.

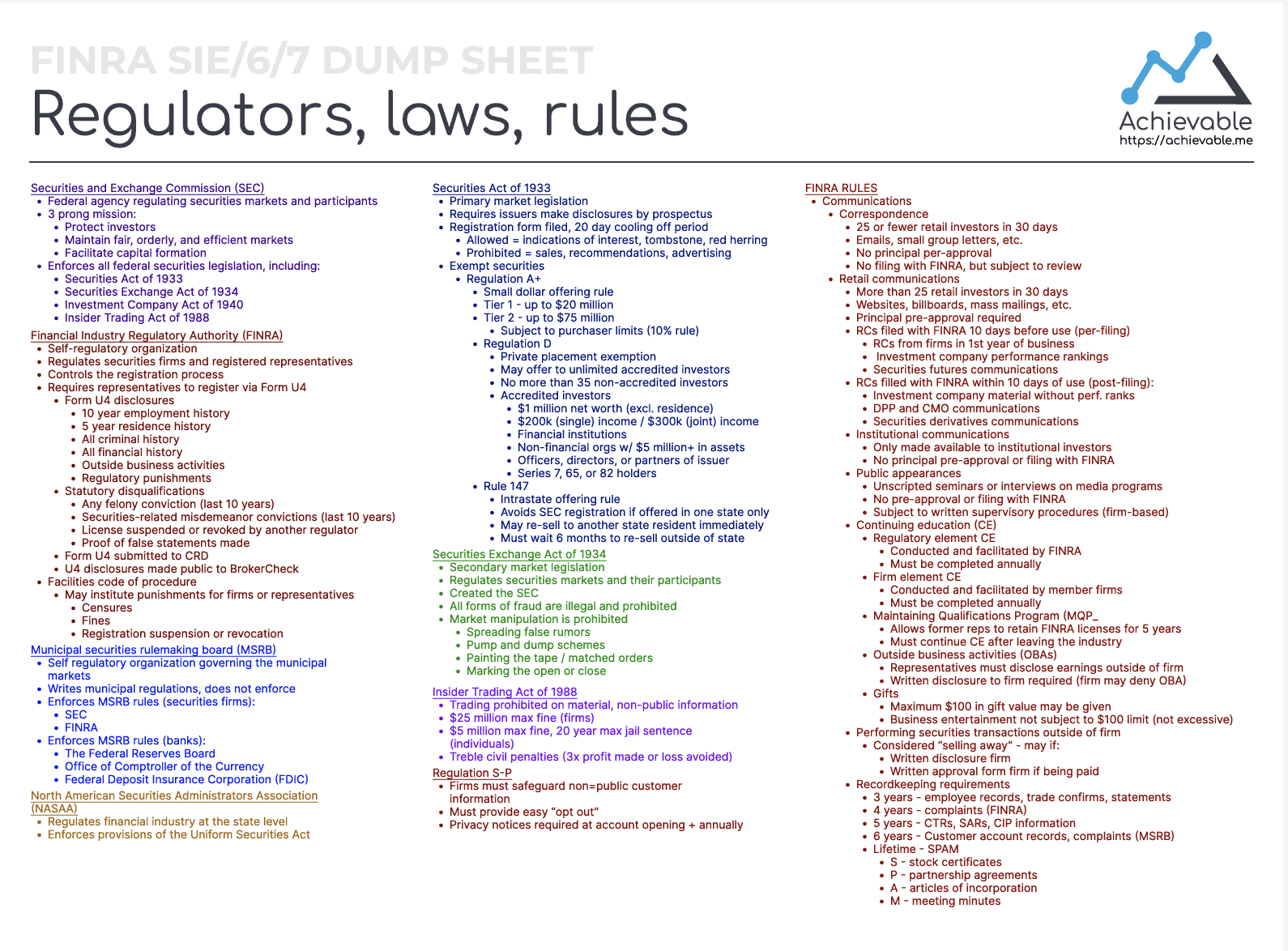

Achievable’s FINRA SIE and Series 6/7 dump sheet is more comprehensive, and it’s the next step on your path to success. It is packed with all the essential regulations, laws, and rules you need to know, from the SEC’s role in protecting investors to FINRA’s disclosure and registration requirements. This sheet breaks down complex topics into easy-to-understand summaries.

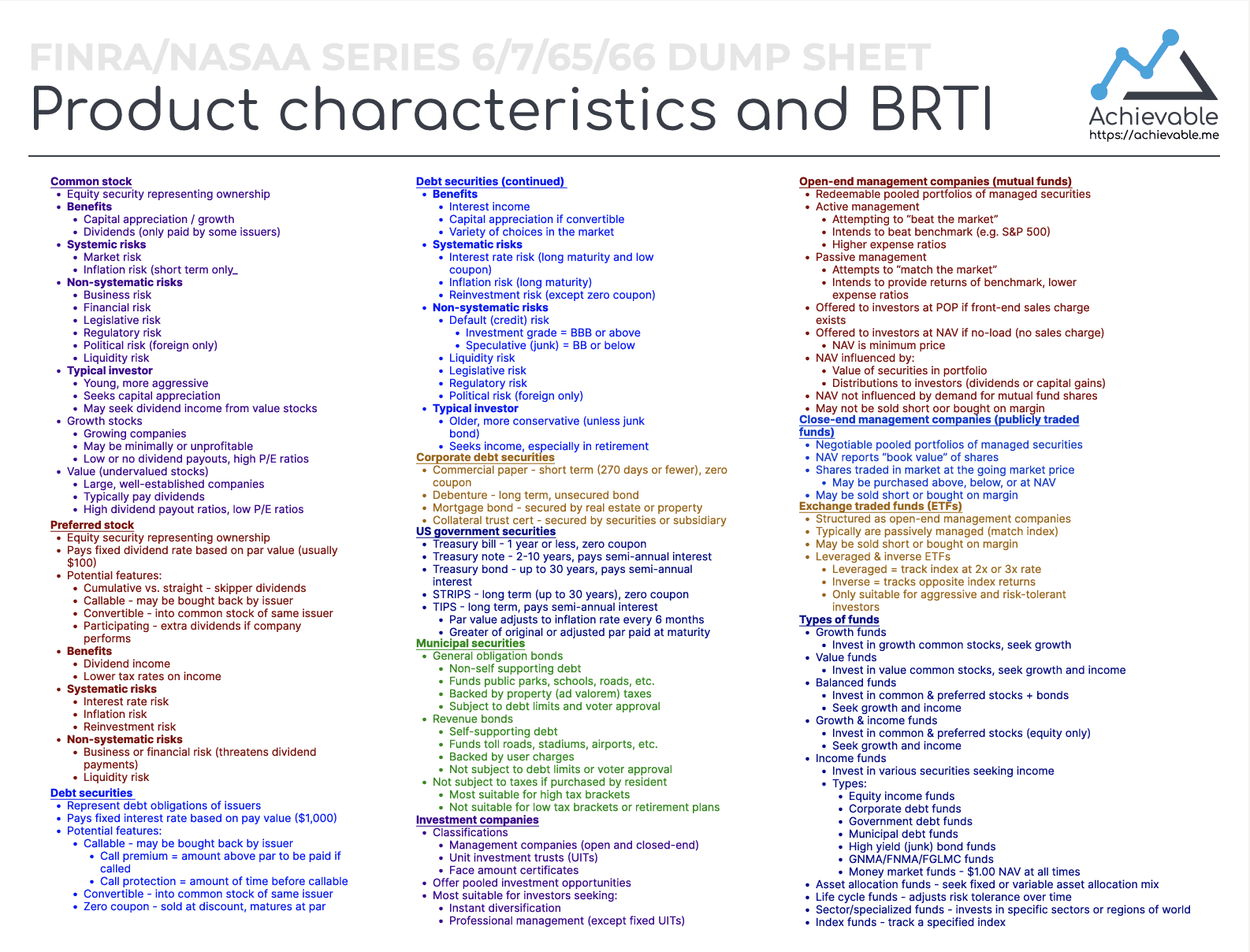

Achievable’s product suitability dump sheet is designed to streamline your study process by breaking down complex financial products, risks, and investment strategies into easy-to-understand sections. Whether you’re aiming to master common and preferred stocks, bonds, mutual funds, or ETFs, this dump sheet will help you confidently tackle exam questions and ace your licensing exams.

Get clear on corporate bonds, municipal bonds, and U.S. government securities. Whether it’s interest income, default risk, or call features, you’ll have everything memorized in no time.

Our breakdown of interest rate, inflation, and liquidity risks makes it easy to know what matters for older, conservative investors or those seeking reliable income. Our sheet makes it simple to understand the difference between actively managed and passively managed funds. Learn when NAV matters, how sales charges affect your investments, and why some funds try to “beat the market” while others “match” it.

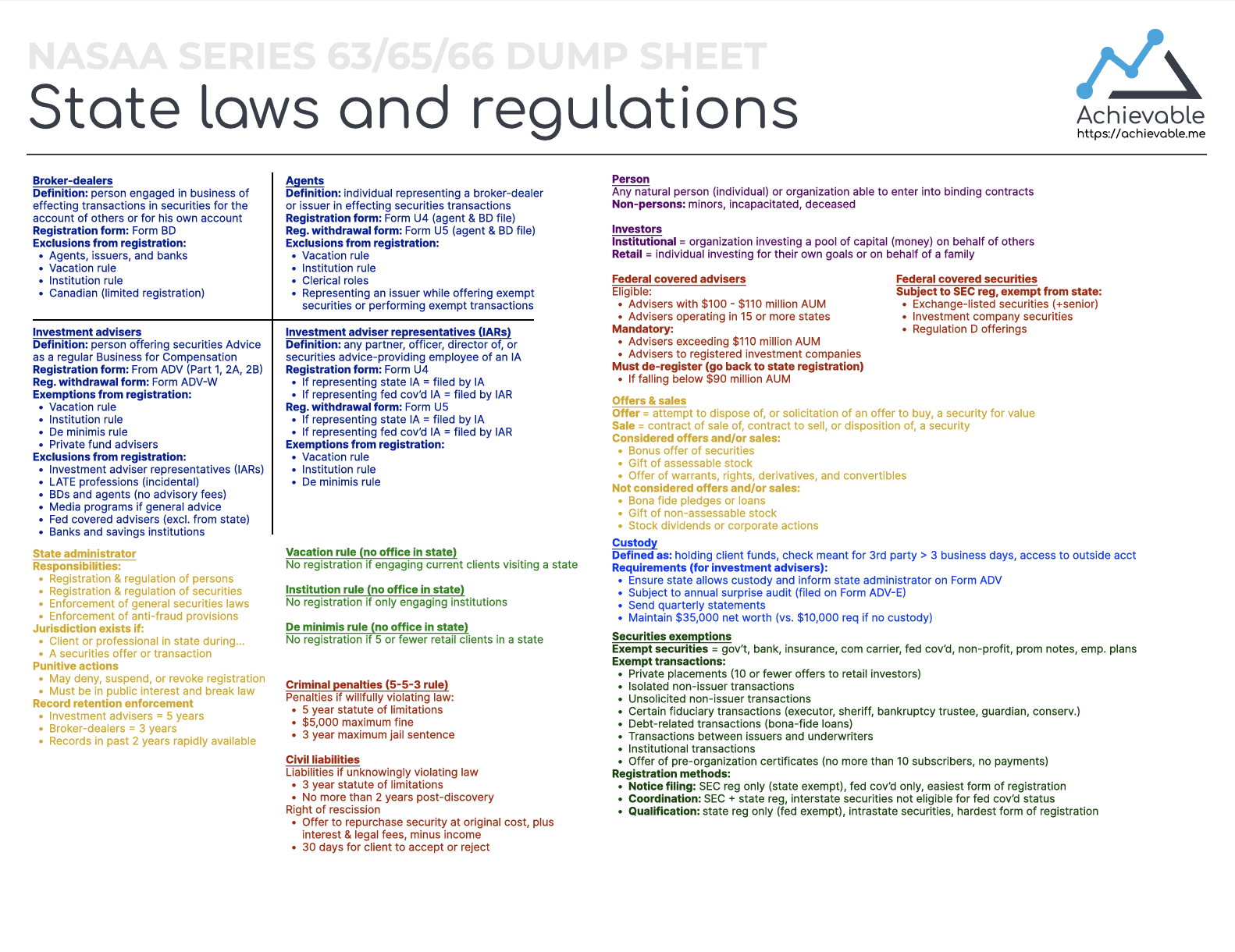

Navigating state laws and regulations is a critical part of preparing for the FINRA/NASAA exams. Our dump sheet simplifies this complex information, providing everything you need to understand broker-dealers, investment advisers, agents, state administrators, and more. With this guide, you’ll master the rules governing securities, exemptions, and penalties, helping you pass your exams with ease and confidence.

Our dump sheet breaks down the role of state administrators in the registration and regulation of both individuals and securities. Learn how they enforce securities law, handle fraud, and impose penalties, such as the “5-5-3 rule” for criminal violations.

Master the exemptions for securities, including government, bank, insurance, and private placements, and understand how exempt transactions (like unsolicited, fiduciary, and debt-related transactions) differ from regular sales.

Get the scoop on the three main registration methods: notice filing, coordination, and qualification. Learn when each method applies and how securities can be registered at the federal and state levels.

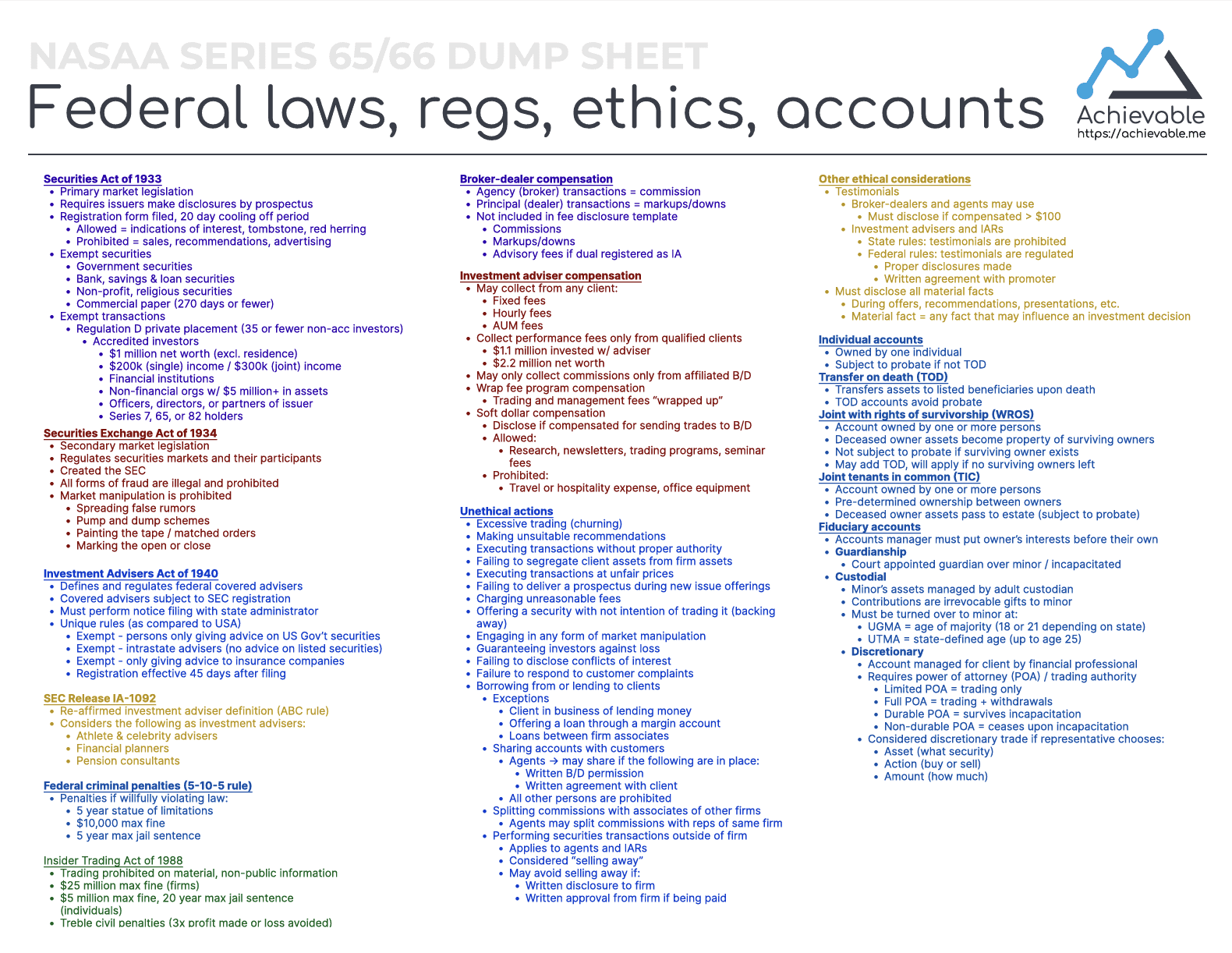

Navigating federal laws, regulations, ethics, and account types is essential for passing the FINRA/NASAA exams. Our dump sheet breaks down key legislative acts, trading rules, ethical guidelines, and various account types, ensuring you have a clear understanding of complex securities regulations. With our detailed guide, you’ll be equipped to tackle any exam question with confidence.

It’s important to note that while dump sheets can be helpful, they aren’t a requirement for success. You may never use one and still perform exceptionally well. However, many test-takers report that creating dump sheets helped calm their nerves during high-pressure situations. The act of memorizing and writing out this information can serve as a mental warm-up, helping you “get into the zone” and approach the test with confidence.

Additionally, the practice of writing out key information ahead of time can aid in committing these formulas and topics to long-term memory. Even if you don’t need to recreate your dump sheet during the test, the process of building it reinforces your understanding and mastery of the material. Whether or not you decide to use this technique, the key is to tailor your approach to what works best for your learning style and the demands of your exam. At the end of the day, a well-prepared mind is your greatest asset.

Introducing Achievable GRE, GRE test prep made for the 2020s. Unlimited GRE quant problems, memory tracking, and more.

Achievable is committed to providing the most current and comprehensive education resources for FINRA and NASAA exams. As a part of this, we’re updating all our FINRA and NASAA prep courses to align with the recent amendments by the Securities and Exchange Commission (SEC) regarding the T+1 settlement cycle. What is Settlement? You probably already …

Today, we launched a new audio playback feature that lets you listen to any chapter of the textbook for all of Achievable’s FINRA courses: FINRA SIE, Series 6, Series 7, Series 63, Series 65, and Series 66. This is part of our commitment to helping students study for and pass their exams with ease. This …